Are You on Track for College Savings? A Self-Directed Coverdell ESA Can Help

Published on October 30, 2018

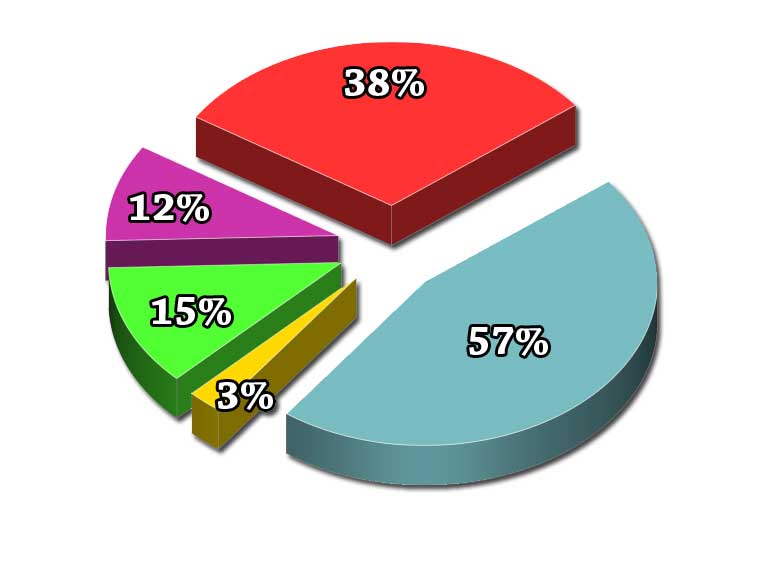

According to a recent Wells Fargo/Gallup Investor and Retirement Optimism Index survey, non-retired investors are busy saving to buy a home or take a major vacation, but when it comes to saving for a child’s college education (or their own retirement), they are falling short. In fact:

- Fifteen percent of respondents said they have met their goal of saving for college costs

- Twelve percent reported they have made a lot of progress

- Thirty-eight percent said they have made no progress

- Fifty-seven percent started saving for retirement

- Three percent have completed their goal

The good news: a report this year from Sallie Mae shows that more Americans are putting away money to help pay for their children’s college costs via tax-advantaged plans that are designed to cover education expenses. However, the rising costs of a college education is making it hard for many investors to reach their savings goals, as illustrated in the Wells Fargo/Gallup survey.

Similar to a 529 plan, a Coverdell education savings account (ESA) can be a powerful way to save for education expenses—especially if it is self-directed.

Self-directed Coverdell ESAs

Given the huge investment that education costs represent, many investors open a Coverdell education savings account to build up savings for qualified educational expenses. It differs a bit from a 529 plan in that it is a trust account for designated beneficiaries up to age 18 and the funds may be withdrawn tax free when used for educational purposes (assuming they are less than the student’s annual adjusted qualified education expenses). You can read more about ESAs in this blog post.

Coverdell ESAs have relatively low annual contribution limits ($2000 cumulatively per beneficiary) so for savvy investors with experience investing in alternative assets, self-directing a Coverdell ESA can boost those education savings. If saving for a home or dealing with one’s own student debt or retirement is taking precedence over funding an ESA, anyone (such as grandparents) may make contributions to the account—and you can enhance the savings potential by investing those funds in nontraditional assets you already know and understand.

Next Generation makes it easy to get started; just go to our ESA starter kit, which walks you through the steps to open and fund an account. Contact our team if you have any questions about Coverdell ESAs or self-directed retirement plans at NewAccounts@NextGenerationTrust.com or 1.888.857.8058.

Back to Blog