Beyond Stocks and Bonds: Is a Self-Directed IRA Right for You?

Published on November 21, 2025

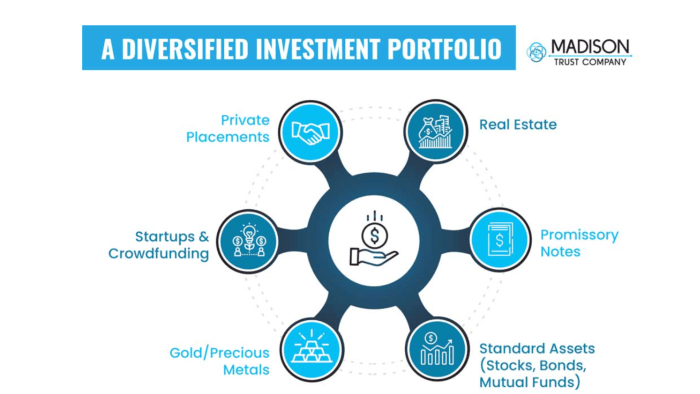

Your IRA probably holds a familiar batch of investments: Stocks, bonds, exchange-traded funds and maybe a mutual fund or two.

As Jerry Seinfeld said, “Not that there’s anything wrong with that.” That investment mix is suitable for the vast majority of retirement savers.

But if you’re the more adventurous type, someone who’s willing to dig into the nuances of investments beyond the standard menu, while also educating yourself on the potential risks of alternative assets, a self-directed IRA might be worth a look.

These funds give you access to assets you can’t hold in a regular IRA, as long as you’re prepared to stay informed and tread carefully.

What is a Self-Directed IRA

A Self-Directed IRA, or simply SDIRA, has the same rules as a Roth or traditional IRA when it comes to contributions and eligibility.

There are two main differences:

- You can own a broader range of assets in a SDIRA.

- Your account must be held by an IRS-approved trustee or trust company. That’s different from more familiar firms like Schwab or Fidelity, which are brokerage custodians and not authorized to administer alternative assets.

What You Can Own

Here’s what the Internal Revenue Service says you can own in a SDIRA.

- Real estate: Rental property, land, commercial buildings

- Private placements: Private equity, private REITs, private operating companies

- Promissory notes: Secured or unsecured lending

- LLCs or Limited Partnership interests: This includes IRA-owned LLCs, if properly structured

- Precious metals: This includes gold and silver bullion that meet certain IRS standards

Tax liens and tax deeds - Cryptocurrency: Held through a custodian that supports digital assets

What You Can’t Own

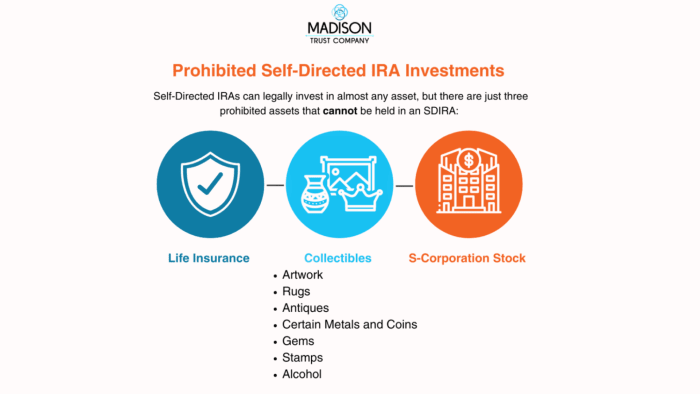

And here’s what the IRS explicitly prohibits:

- Collectibles: Art, rugs, antiques, wine, coins not meeting IRS purity rules

- Life insurance contracts

- Your personal use property: This includes your primary home or your vacation home

- Transactions with disqualified persons: If you, your spouse, your parents or your kids control an entity, you can’t own it in an IRA

How to Evaluate Assets

Investors might incorrectly assume SDIRA custodians vet alternative assets. However, the custodian’s role is strictly administrative. There are still guardrails, but the compliance burden falls on the investor in a way that it doesn’t when buying the Vanguard S&P 500 ETF (VOO) for your Schwab account.

“We help safeguard investors by making sure every alternative asset held in a self-directed IRA is properly documented and compliant, but due diligence rests in the hands of the investor and their financial team,” says Scott Maurer, vice president of business development at Advanta IRA in Clearwater, Florida.

He adds that self-directed IRA custodians such as Advanta, which handle non-publicly traded assets such as physical real estate, physical precious metals, private equity, and private lending instruments, are not permitted to vet or recommend assets.

“It’s a common misconception that we perform due diligence on behalf of clients. Instead, investors, along with their financial advisor, CPA, or attorney, are responsible for fully evaluating the opportunities they choose,” he adds.

How to Avoid Common Mistakes

Many investors who opt for self-directed IRAs are already well-versed in the rules, says Jaime Raskulinecz, founder and CEO of Next Generation Trust Company, a New Jersey-based firm that specializes in providing custodial and administrative services for self-directed IRAs.

“However, we see most prohibited transactions occur in single-member LLCs formed to have the IRA as the sole member to do investments,” she says.

“When we are collecting information to do fair market values annually, we often find that personal funds were commingled with the LLC funds, we see credit cards that were personally signed by the IRA owner or in the owner’s name and not the name of the LLC, and personal expenses put through the LLC,” Raskulinecz adds.

Another mistake is personal use of property held, such as leasing space to a business that the owner of the IRA owns or controls, or leasing a property to another disqualified person, such as a family member.

Consequences of SDIRA Mistakes

“Self-Directed IRAs offer you immense freedom to invest in alternative assets you might be more comfortable with than, say, traditional equities or bonds. But, as in your favorite superhero movie, the saying goes, ‘With great power comes great responsibility,’ ” says Justin Pullaro, a certified financial planner at Moving Wealth Forward in Tampa, Florida.

The unintended consequences of a prohibited transaction can come with a hefty tax bill. The minefield of “prohibited transactions” with “disqualified entities” can be confusing to even the most savvy investors, he adds.

“We try to educate clients before they ever get started by spelling out who their IRA cannot interact with and encourage them to always check in before doing anything, so we can ensure we are in compliance at all times,” Pullaro says.

Meeting Liquidity Needs

Illiquid assets inside a self-directed IRA can create some serious challenges once it’s time for required minimum distributions (RMDs).

Unlike publicly traded securities, private equity, real estate, and other alternatives can’t always be sold or fractionally distributed with a couple of clicks.

This image from Madison Trust underscores the potential complexity of trying to liquidate assets in a timely manner.

“The best way to avoid getting cornered into sub-optimal choices is to plan before you even invest,” Pullaro says.

“Know the time horizon, the cash flow and what RMD amount you will need to distribute during the lifecycle of your investment,” he adds. “It helps to have other IRA accounts in more liquid sources to cover RMD amounts if you don’t have the cash to distribute.”

Jay Zigmont, founder of Childfree Trust in Mt. Juliet, Tennessee, says he encourages clients to open Roth SDIRAs, which do not have RMDs.

“With a Roth SDIRA, you have more flexibility in withdrawal strategies and tax-free returns,” he says. “Since we limit alternatives to approximately 10% of their overall portfolio, clients are unlikely to be squeezed and can avoid liquidity issues.”